Holiday and school-break travel can be exciting, and a bit of advance planning helps ensure your trip starts and ends smoothly. These money travel tips focus on preparing your bank accounts, choosing secure payment methods, and protecting your information so you can enjoy your time away with confidence.

Notify Your Financial Institution Before You Travel

Setting travel notifications with your credit card and debit card issuers is one of the easiest ways to prevent card declines. Letting your financial institution know where you will be ensures that legitimate purchases are not mistaken for suspicious activity. This is especially important during international travel. It helps your transactions go through without interruption and adds an extra layer of security.

It is also helpful to enroll in mobile banking if you have not already done so. While traveling, your institution’s mobile app lets you review recent transactions, monitor balances, and respond quickly if something looks out of place. This level of visibility makes managing your money easier and gives you peace of mind while you travel.

Choose the Right Payment Methods When Traveling

Using a credit card when traveling helps simplify your spending and provides stronger protections than a debit card. A debit card draws funds directly from your checking account, and disputed charges can place a temporary hold on that money while the financial institution completes its review. This can affect bill payments and day-to-day budgeting during your trip.

Additional credit card travel tips:

- Bring at least two credit cards so you have a backup if one is lost, stolen, or reaches its limit.

- Confirm that your cards’ expiration dates extend past your travel dates.

- Store customer service numbers and essential card details somewhere secure so you can contact your issuer quickly if needed.

- Make sure your card is chip-enabled, since chip technology is widely used at home and abroad.

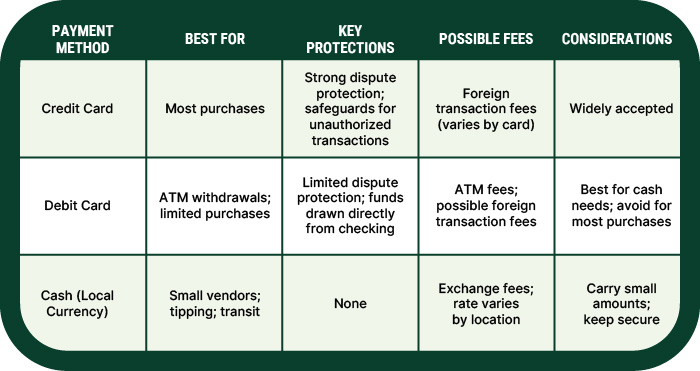

Here is a brief comparison to help you decide when to use each payment method while traveling:

Tip: Even with the protections credit cards offer, it is still important to use them responsibly so your account balance stays manageable after your trip.

What To Do if Your Credit Card Is Lost or Stolen

If your card goes missing while you are traveling, contact your card issuer right away so they can freeze the account and prevent unauthorized charges. Many cards allow you to lock your card immediately through your digital banking app or credit card portal, which can give you quick peace of mind while you work with your issuer. Most issuers can provide a replacement card or help you access emergency funds if needed. It also helps to monitor your account activity closely for a few days so you can report any unfamiliar transactions as soon as they appear.

Strengthen Your Payment Security with a Digital Wallet

Digital wallets work well when traveling domestically and abroad, as long as the merchant accepts contactless payments. Checking your destination’s payment options before you leave can help you know when your digital wallet will be useful and when you may need a traditional card or local currency.

A digital wallet can also help reduce the risk of card skimming because your actual card number is never shared. Each digital wallet purchase uses a unique, encrypted token that protects your information, which is especially helpful in crowded areas or at unfamiliar payment terminals.

Key Currency Tips for International Travel

Foreign transaction fees are small charges added when a purchase is processed through a foreign bank, and they can add up during a trip. Credit cards—and debit cards processed as credit—often provide consistent exchange rates and keep spending simple. It is still helpful to carry a small amount of local currency for taxis, snacks, and shops that do not accept cards. If you exchange money while abroad, converting a larger amount at once can reduce overall fees. When you pay, choose the local currency for a better rate since dynamic currency conversion usually costs more.

Protect Your Information While Traveling

A few simple digital security habits go a long way in keeping your information safe when traveling. When using public or unfamiliar Wi-Fi networks, consider connecting through a virtual private network (VPN). A VPN adds encryption that helps keep your passwords and account details private. It can also help to review your phone setup for financial safety by enabling device passcodes, turning on biometric authentication, and confirming that “Find My Device” settings are active before you leave. Public Wi-Fi is convenient, but it can expose travelers to data theft if used without caution. If you must use the public Wi-Fi when traveling domestically and abroad:

- Avoid checking bank accounts or making online purchases on public networks

- Use different passwords and PINs than you use at home

- Turn off your device’s auto-join feature

- Periodically disconnect and log back in

- Avoid networks that allow access even with the wrong password

- Do not use public computers or shared devices for personal or financial tasks

Keep Personal Items Safe

Physical security matters, too. Don’t keep all your cash and documents in one place. A money belt or another concealed pouch helps protect passports, cards, and a small amount of cash in crowded areas. Keeping important items in more than one secure location reduces the risk of losing everything at once and helps you stay prepared if plans change unexpectedly. When available, a hotel safe can offer another secure spot for items you do not need to carry with you.

Review Your Travel Insurance and Medical Coverage Before You Go

Travel insurance can help cover unexpected issues like trip delays, lost luggage, or cancellations, but most credit card travel insurance benefits do not include full medical coverage. Many cards offer some support, such as emergency assistance or reimbursement for certain travel interruptions, but they usually are not a substitute for dedicated travel medical insurance. Before you leave, it can help to review what your credit card offers and decide whether you need separate medical coverage to stay protected abroad.

Be Smart and Safe When Using ATMs

When using ATMs, a quick check can prevent a serious problem. Inspect the machine before inserting your card, especially if it is not located inside a bank branch. Loose, crooked, or damaged parts may indicate a card-skimming device. Be aware of people standing nearby, as thieves sometimes work in pairs to distract travelers after they enter their PIN.

Memorize your PINs before you travel, and never write them on your cards. When entering your PIN, shield the keypad to prevent “shoulder surfing,” which is when someone tries to watch you enter your information. Small steps like these keep your information safer wherever you go.

A little planning makes both domestic international travel safer, easier, and more enjoyable. Following a few key tips for traveling and taking steps to protect your financial and personal information at home and overseas can help you stay focused on the experiences ahead.

If you have questions about preparing your accounts for travel, Heritage Family Credit Union is ready to help.