Starting a Small Business: A Step-By-Step Guide

Starting a small business can be both exciting and overwhelming—there is something energizing about bringing an idea to life, and there are many decisions to make and steps to take in order to get things off the ground. This guide to starting a small business offers clear steps, practical information, and support for local entrepreneurs who are building something new. Whether you are shaping your idea or preparing to open your doors, the goal of this guide is to provide encouragement and resources that help you move forward with greater clarity and confidence.

Clarify Your Idea and Create a Simple Plan

Before diving into paperwork or startup costs, it helps to outline what you want your business to offer, your goals, and whom you hope to serve. This step gives small business startups a strong footing. Your plan does not need to be formal. A one-page outline works well for beginners and can be a helpful reference point for everything that follows.

A simple plan might cover your products or services, the customers you aim to reach, and how you expect to operate. This preliminary outline of your business objectives makes it easier to navigate budgeting, registering your business, and choosing a structure later on.

Choose the Right Business Structure

Whether to operate as a sole proprietorship or a limited liability company (LLC) is one of the most common questions when starting a small business. Both structures are popular, and each offers different advantages.

A sole proprietorship is the simplest option. The owner and the business are legally the same, which keeps paperwork minimal and taxes straightforward. This is often a practical choice for low-risk or part-time ventures. The drawback is an absence of separation between your personal finances and any business-related debts or legal obligations.

An LLC establishes a legal boundary between you and the business. This structure may provide personal protection if financial challenges arise. Many owners choose an LLC when they expect to grow, hire employees, or enter contracts. It requires some ongoing filings, but the added protection is often worthwhile.

Thinking about your comfort with risk and your long-term plans can help you decide which structure is right for your business. In general:

- A sole proprietorship suits uncomplicated, low-risk operations.

- An LLC may be the better choice for owners who want liability protection or expect to expand.

Plan for Startup Costs and Set a Realistic Budget

Thoughtful budgeting gives small businesses a clear understanding of the resources they need as they get started. Costs vary depending on your industry, tools, equipment, and whether you operate from home or a workspace.

Many new owners wonder whether $10,000 is enough to start a small business. For many service-based or home-based ventures, this amount is suitable. Some businesses need even less, while those requiring equipment or inventory may need more. What matters most is setting a realistic budget that supports your early goals.

These financial tips for small business owners help you enter your first months with confidence and flexibility:

- Focus on essential costs.

- Consider shared or used equipment.

- Build a small financial cushion for unexpected needs.

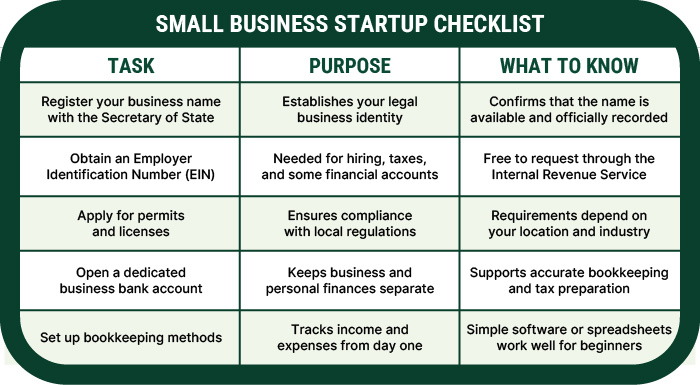

Register Your Business and Complete Key Startup Tasks

Once you determine your costs and structure, a few practical steps will help you officially establish your business. These tasks give your business its legal identity and establish a foundation of responsible financial management.

With these essential elements in place, you can focus on refining your offerings and serving customers.

Keep Business and Personal Finances Separate

Separating your business and personal finances is one of the most practical tips for starting a small business. A dedicated business account creates clear records, reduces tax complications, and makes it easier to understand your business’s true performance.

Clear financial records also help build credibility. Lenders, vendors, and partners value organized bookkeeping, and separate business banking accounts demonstrate responsible management.

Tools That Support Financial Separation

As your business grows, several financial tools can help reinforce this structure and simplify day-to-day management:

- Business credit cards can help manage cash flow while keeping expenses clearly separated.

- Digital banking tools simplify tracking transactions and record reconcilliation.

- Remote deposit capture (RDC) allows you to deposit checks electronically without visiting a branch.

- Automated clearing house (ACH) payments support secure electronic transfers for payroll or vendor payments.

- Merchant processing services make it easier to accept card payments, with options that offer competitive rates, low setup costs, and no long-term contracts through trusted partners.

Heritage Family Credit Union encourages this separation as part of developing responsible financial habits.

Build a Financial Foundation for Long-Term Stability

Establishing healthy financial habits early on can make the future stages of business ownership smoother and more seamless. Tracking initial spending, planning for quarterly taxes, and keeping a small reserve can help you navigate the natural ups and downs of growth.

Basic budgeting tools, such as simple spreadsheets or entry-level bookkeeping software, offer a clear picture of what your business needs now and how to prepare for future expenses. Establishing good financial practices at the start supports stability and helps small business owners plan for what is ahead.

Starting a business is a big decision, and having the right guidance can help you feel more prepared. As you continue planning and shaping your ideas, remember that you don’t have to navigate the process alone.

Heritage Family Credit Union is here to support you with friendly service, practical guidance, and resources that help local businesses thrive. If you are ready to move forward, we welcome you to reach out or visit any of our branches. Our team is always glad to answer questions, talk through your plans, and help you build the business you envision.