Share Certificate Laddering: A Smart Way To Maximize Your Savings

Saving for the future often means finding the right balance between growing your money as quickly as possible over time and maintaining access to your funds for planned and unforeseen life moments. One strategy that can help is share certificate laddering, a scheduled approach to savings that disperses funds across multiple timelines. This method can support steady growth and peace of mind, especially for savers who want to make the most of changing term share certificate rates without locking everything away at once.

What Share Certificate Laddering Is and How It Helps Your Savings

Share certificate laddering is a savings approach that divides your money among multiple term share certificates with different maturity dates, rather than placing all funds into a single certificate at one time. This helps support long-term savings goals while maintaining regular access to portions of your funds.

Why is it called laddering? Well, each share certificate is like a rung on a ladder - each one has a different term and timeframe, but all are connected and part of the same leveled and layered savings strategy. One rung close to the bottom might mature in six months, another one in the middle in a year, another certificate closer to the top in two years, and another at the top in three years. As each certificate comes due, you can choose to reinvest it at current rates or use the funds for another purpose, while the remaining certificates continue earning dividends.Regardless of what you do, your savings continue to climb with a sound strategy where your money is working harder and more efficiently for you, maximizing both dividends and flexibility.

Short-Term vs. Long-Term Share Certificates: Finding the Right Mix

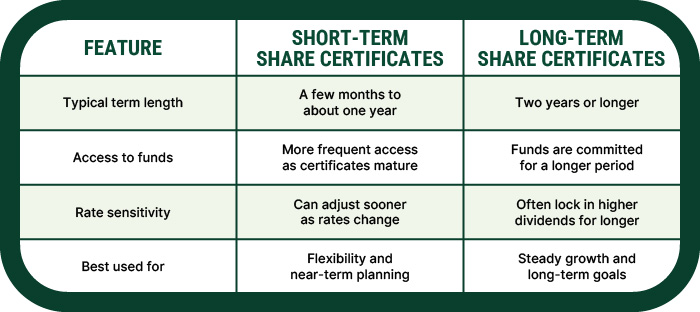

Deciding between short- and long-term share certificates often depends on timing, financial goals, and comfort with committing funds. Each option plays a different role in a laddered structure, particularly as share certificate rates shift over time. Understanding how they complement one another can help savers make more informed choices.

Rather than choosing one over the other, combining short- and long-term certificates creates a balanced savings ladder strategy that supports growth while maintaining regular access. This makes it easier to adjust as financial needs and rate environments change.

Balancing Liquidity and Growth Without Guesswork

One of the key advantages of laddering is how staggered maturity dates support both access and growth at the same time. As each share certificate reaches its term, you’re not faced with an all-or-nothing choice. Funds can be withdrawn if needed or reinvested, while the rest of your savings continues earning dividends.

This structure also helps reduce both rate risk and timing risk. Instead of committing all funds at a single rate or trying to predict the best time to invest, laddering spreads those decisions over time. When rates rise, maturing certificates can be renewed at higher levels. When rates fall, longer-term certificates help preserve previously earned value.

By offering consistent opportunities to adjust within a planned schedule, laddering makes it easier to maximize savings and supports steady, predictable growth that adapts as market conditions and personal circumstances change.

Pairing Share Certificates With a Savings Account

Even with a laddered approach, a conventional savings account remains essential. Savings accounts provide immediate access to funds for everyday expenses, unexpected costs, and emergency fund needs without penalties or timing concerns.

In a balanced plan, savings accounts address short-term and emergency needs while share certificates focus on longer-term growth. This separation helps prevent early withdrawals, allowing dividends to remain intact and financial goals to stay on track.

Together, this combination strengthens overall share certificate savings outcomes by providing stability and supporting growth without sacrificing access.

Flexibility When You Need It Most

Beyond the structure itself, laddering also gives savers ongoing control. Maturing share certificates create regular decision points, allowing you to reassess priorities as each certificate reaches maturity rather than being tied to a single timeline.

At each maturity, funds can be reinvested, shifted to a different term, or redirected to support changing needs such as a major purchase, reduced income, or new savings goals. This flexibility allows the ladder to evolve over time rather than remain static.

Because access is built in through scheduled maturities, share certificates can still provide flexibility when you need access to your money, making laddering a practical strategy that evolves as life changes.

Share certificate laddering offers a thoughtful way to grow savings while maintaining flexibility as goals and needs change over time. If you’re interested in exploring whether a laddered approach best fits your financial future, the team at Heritage Family Credit Union is here to help. Contact us today to learn more about building a share certificate strategy that works best for you.